Blog

Beyond Europe: Are there ambitious electrification targets across major markets?

An increasing number of large car manufacturers have voluntarily announced targets to electrify all or a portion of their fleets over the next decade. Some are even aiming to move quicker than regional regulations require. Although these are not binding commitments, they can reflect future vision and manufacturers’ willingness to decarbonize vehicle fleets.

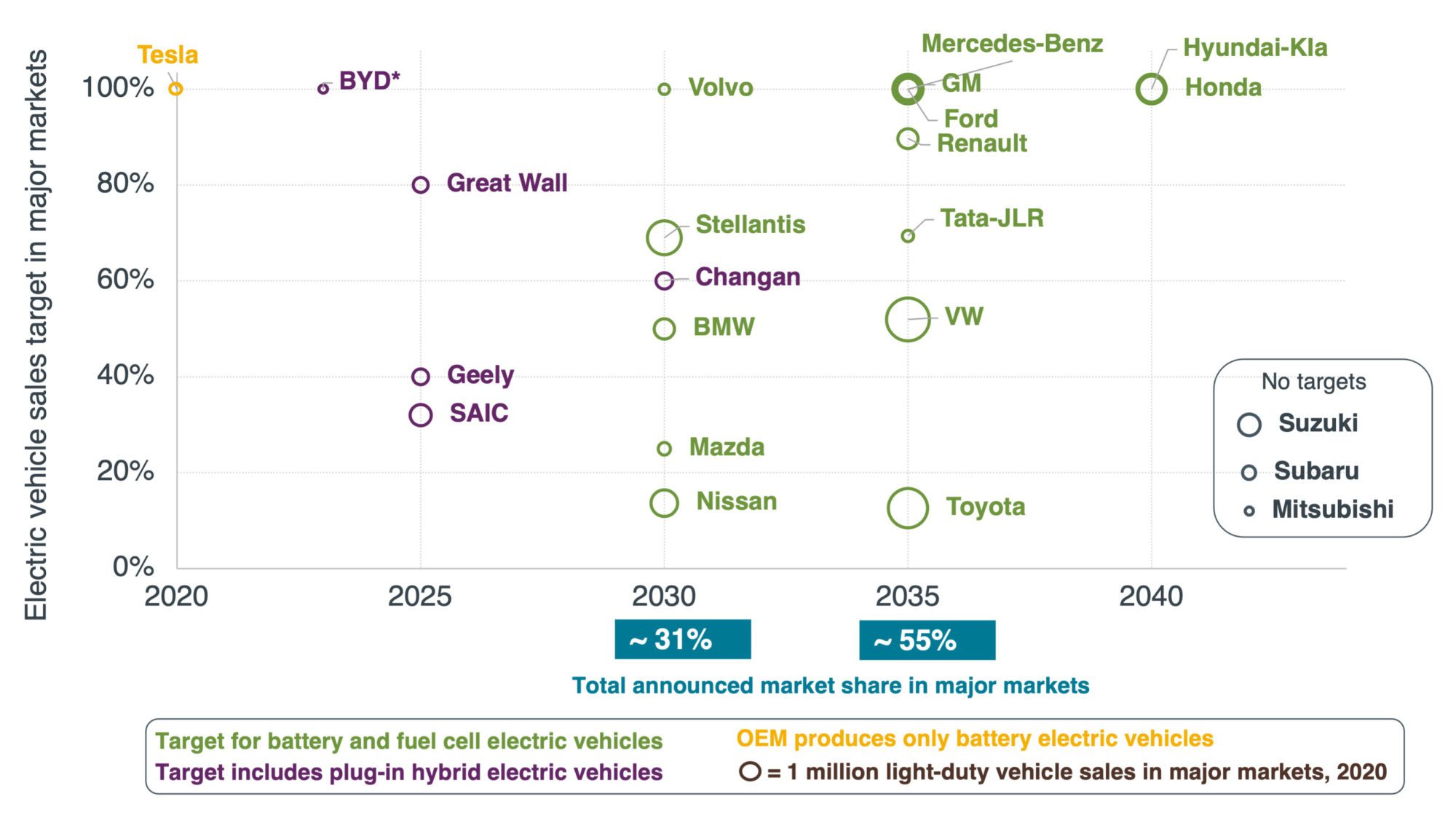

The ambition of these targets can be assessed by several factors, including time frame, geographical coverage, and technology type. The figure below summarizes announced electric vehicle (EV) targets for light-duty vehicles (LDVs), including passenger cars and light commercial vehicles, by major manufacturers in six major markets: China, the European Union, India, Japan, Korea, and the United States. These six markets account for about 80% of total annual global LDV sales, and the major manufacturers account for about 95% of those sales, or about 76% of total annual global auto sales. For manufacturers that have announced different EV targets for each region, we normalized the regional targets by the sales in the region. For manufacturers that have targets for multiple time frames, the figure mostly shows the most ambitious sales share targets.

Figure. Manufacturer targets, as of October 2022, for the future share of electric passenger cars and light commercial vehicles in six major markets. *BYD stopped producing conventional internal combustion engine vehicles in March 2022 and EVs will get close to 100% of sales in 2023.

Among the 23 major manufacturers we assessed, Tesla is unique because it already only produces battery electric vehicles. Of the rest, 19 manufacturers have publicly announced targets for EVs. Volvo has the most ambitious target of 100% zero-emission vehicle (ZEV) market share for LDVs by 2030. We define ZEVs as those that generate zero harmful emissions at the tailpipe.

Two prominent European manufacturer groups, VW and Stellantis, are more ambitious in their commitments in Europe than elsewhere and focus on passenger cars, rather than on the broader LDV segment that includes light commercial vehicles. Among the multiple brands under the VW Group, VW has a target of 70% ZEV sales by 2030 and 100% ZEVs by 2033 for passenger cars in Europe, but the targets for the United States and China are only 50% ZEVs by 2030. Similarly, Audi’s 100% ZEVs by 2035 target excludes China, and Skoda and Porsche’s ZEV targets, 60% and 80% by 2030, respectively, are only for LDV sales in Europe. Therefore, the aggregated targets of VW group are 34% by 2030 and 52% by 2035.

Stellantis has a 100% ZEVs by 2030 target in Europe for the passenger car segment and only a 50% ZEVs by 2030 target in the United States for the LDV segment; these two regional targets lead to an aggregated 69% global ZEV target by 2030. Renault has ZEV targets for sales in Europe only, where it sells 90% of its LDVs: 100% ZEVs by 2030 for Renault and 100% ZEVs by 2035 for Dacia. BMW has a more ambitious target for its Mini—100% ZEVs by 2035—compared with the overall BMW Group’s global commitment of 50% ZEVs by 2030. Mercedes-Benz is one of the signatories to the COP26 Declaration, and thus will work toward 100% ZEVs by 2035 in the LDV segment in major markets. The company has also stated that it will aim to go all electric by 2030, “where market conditions allow.”

GM and Ford, the two U.S. manufacturers, are both signatories to the COP26 Declaration and thus will work toward a full ZEV transition in leading vehicle markets by 2035.

The Chinese manufacturers—BYD, Great Wall, Geely, SAIC, and Changan—all count plug-in hybrid electric vehicles toward their targets. BYD has produced only battery electric and plug-in hybrid vehicles since March 2022. The targets are mostly short-term for the other manufacturers because China’s electrification target and policies are piecemealed and short term, and the current national electrification target is 20% by 2025. Nevertheless, China’s LDV market has already exceeded that target with 24% EVs (19% ZEVs) sold from January to September 2022, according to Marklines data.

Tata Motors recently announced a more ambitious target for passenger cars—50% ZEVs by 2030—and it mainly covers sales in India. Its subsidiary, Jaguar Land Rover, signed the COP26 Declaration.

The Japanese and Korean manufacturers are more cautious in making announcements, and most of them are more ambitious with their targets in Europe than elsewhere. Toyota formerly included hybrids in its global electrification plan, but recently updated its target for the EU market to aim only for new ZEV sales by 2035. This is still a poor ZEV sales target globally, though, because only 12% of Toyota’s sales are in the European Union. Nissan has a 40% ZEV target by 2030, but only for its sales in the United States. Nissan also has a 50% by 2030 global target, but it includes conventional hybrids and is therefore not counted even as an EV target. Mazda announced a global target of 100% “electrified” vehicles by 2030, but only 25% of the sales will be ZEVs.

Honda has a 100% ZEVs target globally by 2040 and a relatively more ambitious target of 80% ZEVs in Europe by 2035. Honda also recently released an EV expansion strategy, but it includes no strengthening of the ZEV target. Hyundai–Kia also has a more ambitious target in Europe, 100% ZEVs by 2035, but its sales in Europe are only 18% of its LDV sales in major vehicle markets; for the rest of its markets, the company only has a 100% ZEVs target by 2040.

Suzuki and Mitsubishi don’t have any announced targets yet. Subaru’s target is not counted because it includes conventional hybrids.

If manufacturers meet the goals described above, that works out to approximately 31% EVs by 2030 and 55% by 2035 in the six major vehicle markets. The numbers change to 29% by 2030 and 52% by 2035 if we take account of the LDV sales of others beyond these 23 manufacturers. This is still far from the 90% ZEVs for new sales by 2035 in the major vehicle markets ambition that we’ve shown could put the global vehicle fleet on a 2 °C compatible trajectory. Nevertheless, manufacturer announcements are expected to evolve along with the development of more ambitious EV-forcing policies in regions other than Europe.

As this global comparison reflects, manufacturers are adapting their product plans in Europe in response to the Fit For 55 regulation package, which calls for a 100% reduction in CO2 emissions or a full ZEV transition by 2035. Given this, we could expect more ambitious global announcements if other major vehicle markets such as the United States and China set regulations to drive accelerated ZEV supply. What’s more, a public announcement of a target is only a first step. It’s critical to track subsequent actions such as ZEV investment and ZEV uptake progress to ensure these announcements are not just empty talk.